APEX 2025 Presentations

Explore the presentations from the APEX 2025 convention. Revisit your favorite topics, explore sessions you missed, and share highlights with friends and colleagues.

Mark your calendar for APEX 2026—happening October 13–16 at the Mohegan Sun Casino in Uncasville, Connecticut. Registration is now open at: www.ccua.org/apex26.

Presentations

Global Women’s Leadership Network Session: Breaking Barriers, Building Bridges: Women Leading the Future

Joyner Eke Ph. D., CMC Drug Substance Purification Lead of Alltrna

This inspiring session explores what it means to lead with authenticity, confidence, and purpose in today’s evolving workplace. Attendees will learn why representation matters in leadership, how to overcome self-doubt, and the importance of lifting others through mentorship and sponsorship. The discussion also dives into navigating change and innovation with resilience while maintaining balance and well-being as a leader.

Keynote Session: Top Forces Shaping the Future of Finance

Allison Cerra, CMO of Alkami Technology

Financial institutions, especially credit unions, are navigating a wave of unprecedented changes, from shifting generational dynamics among consumers and employees to increasing regulatory pressures and a rapidly evolving technology landscape. Identifying the most significant trends can be challenging and viewing these shifts as opportunities rather than threats is even more difficult. This talk explores how changes in consumer behavior, business models, workforce expectations, regulatory demands, and technology are reshaping the future of banking. Attendees will gain insights from recent market research, learn a mnemonic device to enhance recall, and receive practical W.I.S.D.O.M. for key functional areas, including IT, sales, marketing, and human resources.

Keynote Session: Empowering Tomorrow: A Letter to the Future Leaders

Linda Nedelcoff, Chief HR Officer & Strategy at TruStage

As we look toward the future of the credit union industry, one thing is clear: success will be driven by the talent we nurture today. Explore the intersection of innovation and leadership, and gain insights on how credit unions can not only stay ahead but thrive in a rapidly evolving workforce landscape. From fostering internal growth through talent development, to leveraging AI to enhance recruitment, training, and member experiences, this discussion will empower leaders to embrace both timeless strategies and forward-thinking technologies. Become inspired to be the catalyst for change, creating a workforce that is not only skilled but also engaged, driven, and ready to shape the future of the credit union movement.

Pre-Conference Learning Lab: Stay Inspired Preparing for the NCUA Succession Planning Rule: Compliance, Strategy, Sustainability

Alison Herrick, CPA, Partner at Wipfli

This session will provide a comprehensive overview of the final rule, including its purpose, scope, and practical implications for credit union leadership and governance.

Pre-Conference Learning Lab: Think Big, Start Smart: Why Data and AI Strategy Is Critical for Small Credit Union Growth

Pat Lapomarda, Director of Data Science of Arkatechture

Learn how small credit unions can use data and AI to compete and thrive. This session shares practical steps to build a scalable strategy, improve member experience, and streamline operations—even with limited budgets. Walk away with clear starting points and proven ideas to drive growth and innovation.

Learning Lab Session: Top 5 Compliance Pitfalls Credit Unions Should Avoid in 2026

Crystal Streeper, League Compliance Lead & Training Coordinator of ViClarity

In this fast-paced session, we’ll spotlight the top five compliance pitfalls credit unions must avoid in 2026. From evolving regulations to common operational blind spots, you’ll get quick, actionable insights to help safeguard your institution. This discussion offers key takeaways to strengthen your compliance program and reduce risk.

Learning Lab Session: Boosting Membership and Loans—High Converting Campaign Strategies for Credit Unions

Dean DeCarlo, Founder of Mission Disrupt

In an increasingly competitive financial landscape, credit unions need marketing strategies that don’t just attract attention but drive real action. This session uncovers the key ingredients of high-converting digital campaigns designed to increase membership and loan applications. Learn how to craft compelling offers, optimize your targeting, and fine-tune your messaging to maximize conversions.

Join Mission Disrupt to discover practical, results-driven marketing strategies that empower your credit union to attract more members and grow loan volume efficiently. Whether you're looking to optimize existing campaigns or launch new ones, this session will provide the insights you need to drive sustainable growth.

Learning Lab Session: Pursuit of Scale: Industry Mergers & Consolidation

Caroline Vahrenkamp, Director of Filene Research Institute

Consolidation continues to reshape the credit union industry as credit unions look for economies of scale. This presentation provides a data-driven perspective on aligning the pursuit of scale with member value and organizational sustainability. This session helps leaders answer critical questions like: How do economies of scale help credit unions do more for their members? How is the merger landscape shifting through mergers of equals, bank acquisitions, and system-level consolidation? What are the drivers, risks, and rewards of mergers? Together, we discuss how to decide whether and when a merger makes sense and what considerations leaders should keep in mind to navigate a merger and position credit unions for renewed success.

Board Track Learning Lab Session: Examining Rate Cycles and their impact on the Balance Sheet Investment and Investment Strategy

Kevin Lynch, Managing Director of Investments of Oppenheimer & Co. Inc.

With the FED restarting the Easing cycle with a 25 BP cut last month, we will contemplate what that could mean for credit union balance sheets and interest income. We will examine the current state of rates and what we might expect as we head into 2026. Finally, we will introduce investment strategy concepts designed to protect against and even thrive in a falling rate environment.

Learning Lab Session: From Attrit to Commit: Transforming Inactive Membership into Multi-Product Relationships

Harrison Hochman, Co-Founder & CEO of Sparrow

All credit unions have members who remain relatively inactive—such as those who are indirect, dormant, or single-transaction. Converting these disengaged individuals into active, multi-product members calls for a strategic approach. In this session, Sparrow CEO Harrison Hochman shares proven strategies to revitalize inactive memberships and build lasting relationships.

Learn how to take relationship-building beyond the branch using technology and outreach that replicates in-person service. Discover smart ways to automate engagement without losing the personal touch, and gain insight into practices that drive loyalty and deeper member connections.

Learning Lab Session: Navigating the Compliance Landscape - Hot Topics for Credit Unions

Glory LeDu, President & CEO of CU Risk Intelligence of InfoSight

The regulatory compliance landscape is more challenging than ever. How can credit unions stay on top of everything? Don't let anything slip through the cracks. Join this session to stay ahead of what is happening in the regulatory environment and learn about the support, tools, and resources credit unions have to manage it all.

Fintech Pitch Lab Session: Unified Fraud Intelligence in Action: Proactive Defense Through the CCUA Anti-Fraud Hub

Nilabh Ohol, VP of Product of FiVerity

Fraudsters are moving faster than ever, testing new schemes across multiple institutions before striking at scale. In this live demonstration, FiVerity will showcase how the CCUA Anti-Fraud Collaboration Hub connects fraud signals from member credit unions and the broader financial community into Unified Fraud Intelligence. Attendees will see how the Hub brings together data from across systems, detects emerging threats, reduces false positives, and enables secure collaboration - transforming fraud prevention from reactive “firefighting” into proactive, into a cross-industry, community-wide defense.

Fintech Pitch Lab Session: Turn Gen Z Into Members for Life with Products That Meet Them Where They Are

James Chemplavil, Founder of Salus

Younger consumers are looking for solutions that previous generations didn't use. Credit unions can bring cutting edge fintech solutions to Gen Z members, and create members for life, by using Salus. Through Salus, credit unions can offer products like digitally underwritten microloans that deliver cash to members in minutes. Microloans help young members through difficult times, increase direct deposit relationships with credit unions, and help credit unions attract and retain younger members.

See how Salus products like microloans, earned wage access, predictive analytics, and more can help your credit union give Gen Z the solutions they want, from the credit union they trust.

Fintech Pitch Lab Session: Helping Members Thrive with Safer, Smarter Family Banking

Kara Brewer, Chief Strategy Officer of True Link

Credit unions have a powerful opportunity to support members managing money for loved ones – and True Link helps make that possible. Built with insights from serving over 250,000 families over 13 years, our platform offers customizable spending controls, caregiver-managed account features, and fraud prevention tools designed for families with complex financial needs – including aging adults, teens, and individuals with disabilities or in recovery. With True Link, credit unions can help prevent fraud, generate non-interest income, and acquire the next generation of members – all while deepening relationships and supporting members through life’s most challenging moments.

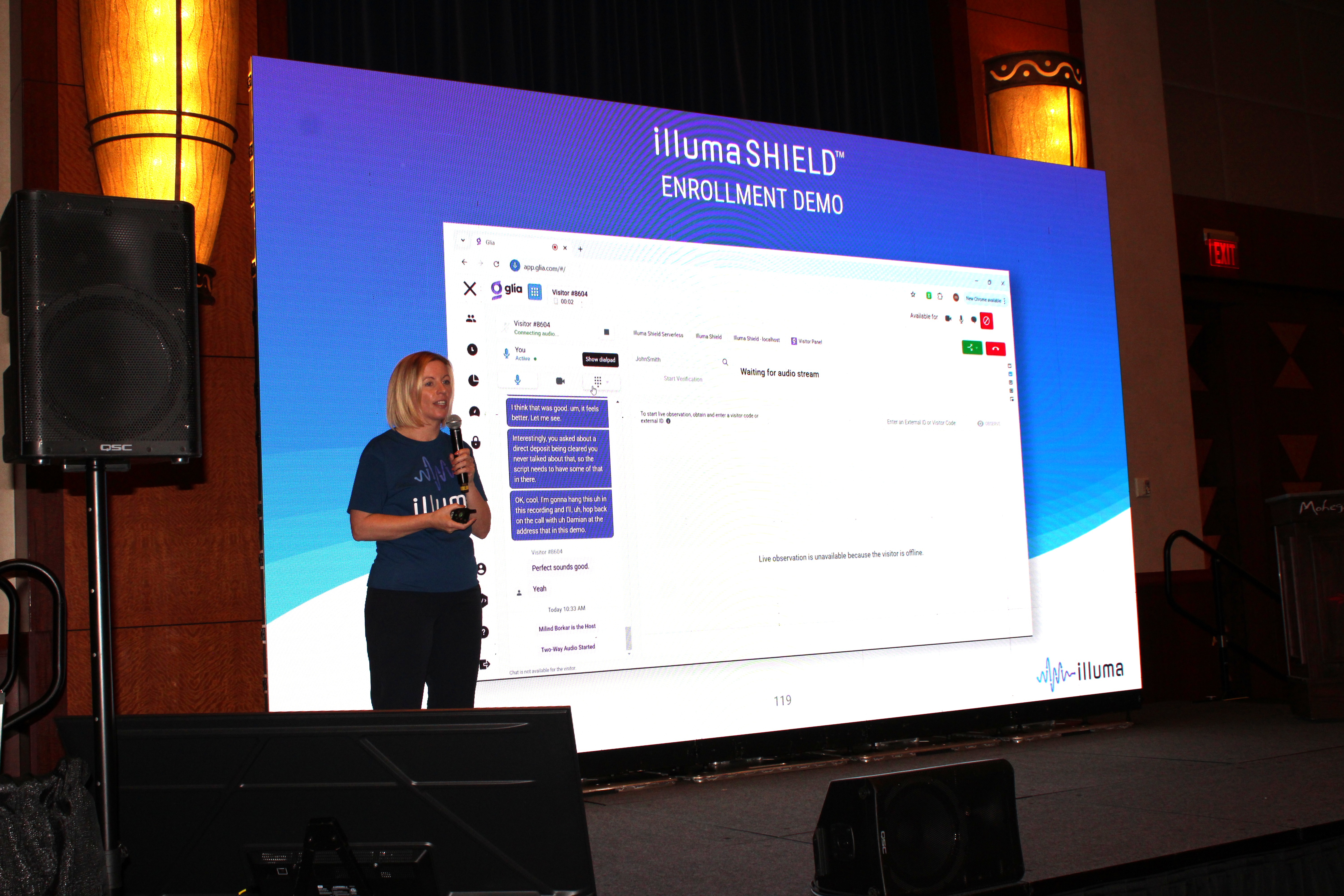

Demo Session: Say It to Secure It: Voice Tech vs. Deepfakes & Fraud

Amy Travers, VP of Sales of Illuma

Fraudsters are using AI to mimic voices, steal identities, and create convincing fake conversations—but voice technology is striking back. In this session, discover how voice authentication can prevent fraud before it happens, identify deepfakes in real time, and provide a smooth, secure experience for legitimate users. Join us for a live demo, real-world case studies, and an inside look at how voice is emerging as the new frontline in digital security.

Demo Session: Open Accounts and Offer Loans like a Fintech

Kristen Cooper, Enterprise Account Executive of Clutch

See how Clutch empowers Credit Unions to deliver a modern digital experience for account opening and loan applications. In this demo, we’ll showcase how you can launch seamless, mobile-first account opening and lending flows that rival the best fintechs—without overhauling your current systems. From instant identity verification and digital funding to automated decisioning and personalized loan offers, Clutch accelerates growth, improves conversion, and provides the kind of frictionless member experience today’s consumers expect.

Mortgage Lending Update: The Future of Real Estate Lending & Non-Conforming Mortgage Options

Bryce Jackson, Director of Sales at MemberClose & Bryant Ottaviano, CEO of Pivot Lending

In today’s shifting economy and rate environment, credit unions need flexible lending solutions to stay competitive. This session covers jumbo loans, investment properties, and alternative income options—along with a look at secondary market (Fannie, Freddie, and the FHLB0 and what’s on the horizon for real estate lending.

Highlights from APEX 2025 at Mohegan Sun

APEX 2026

Registration is open for APEX 2026 in Uncasville, Connecticut at Mohegan Sun Casino! We can't wait to see you there on October 13th through October 16th, 2026.