CU DigiLend

How Credit Unions Are Teaming Up with Fintech to Fast-Track Loan Approvals

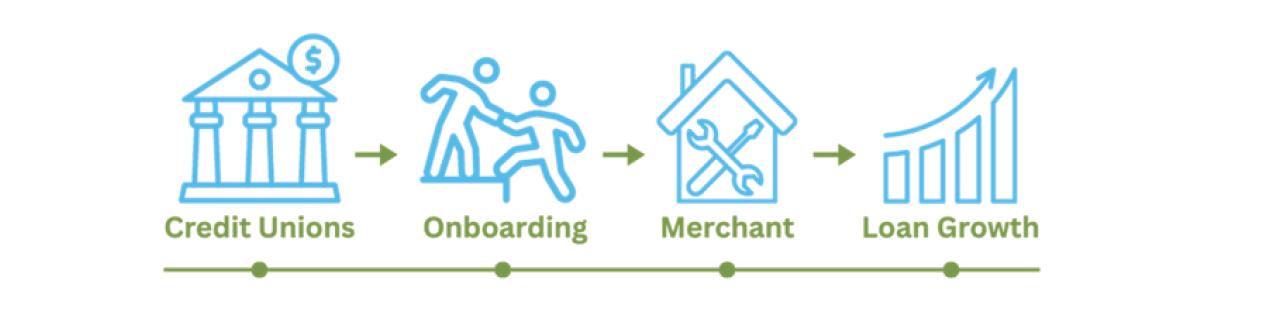

Credit unions have always prioritized people over profits, but that doesn’t mean they can’t innovate. Today, members expect fast, seamless experiences when applying for loans. That’s where fintech partnerships come in. By integrating with platforms like CU DigiLend, credit unions are transforming how they serve members, delivering faster loan decisions, greater access to capital, and a more streamlined application process. Here's how fintech is helping credit unions close the gap between traditional service and modern expectations.

Speeding Up the Lending Process

One of the biggest frustrations for borrowers is waiting days, or even weeks, for a loan decision. In today’s instant-access world, that simply doesn’t cut it. Fintech platforms empower credit unions with automated decisioning tools, allowing them to approve loans in minutes instead of days. CU DigiLend, for example, uses real-time data and flexible underwriting to help credit unions respond to applicants faster without compromising risk standards.

Reaching Members Where They Are

Gone are the days when members visited branches to apply for financing. With point-of-sale (POS) lending solutions, credit unions can meet members right where they’re making purchasing decisions, whether that’s at a local HVAC business, dental office, or other local businesses. By partnering with CU DigiLend, credit unions can embed financing options directly into their community's sales ecosystem, offering easy access to credit at the moment of need. It’s a win-win: local businesses close more sales, and credit unions grow their loan portfolios with high-quality borrowers.

Staying Competitive Without Losing the Personal Touch

Big banks and online lenders are fast, but they often lack the relationship-driven care that credit unions are known for. The right fintech platform doesn’t replace that, it enhances it. With CU DigiLend, credit unions can maintain their community-first approach while delivering the kind of speed and convenience members expect from modern financial services.