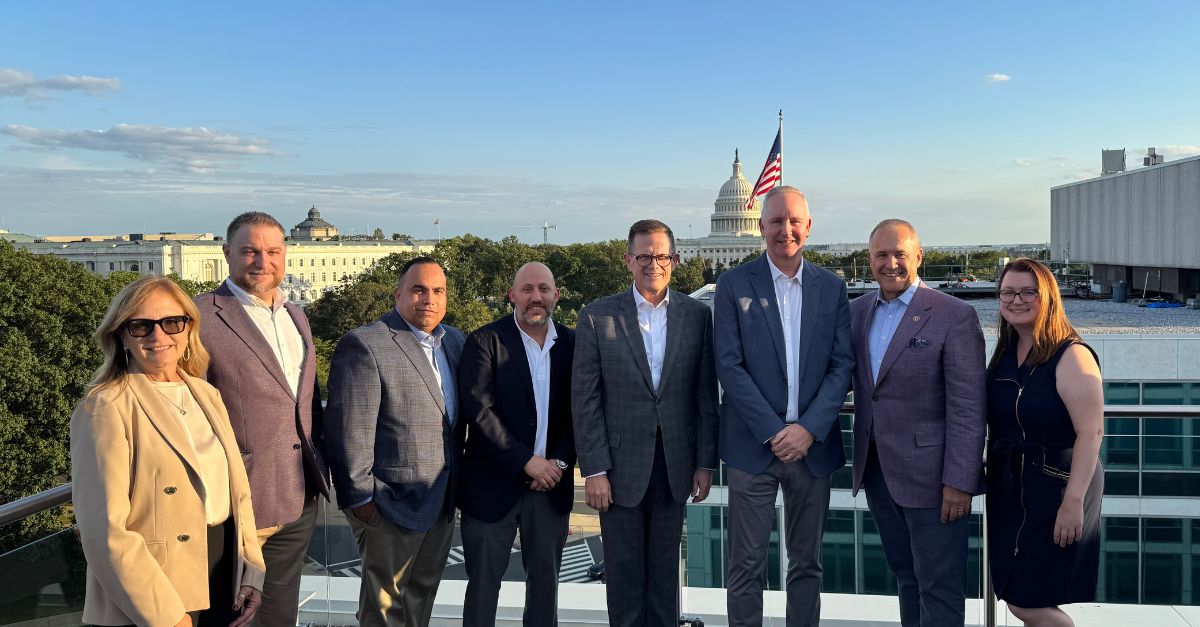

CCUA in Washington D.C. - Member Credit Unions Meet with Elected Officials

This week, Ron McLean, President/CEO. Adrian Velazquez, Chief Advocacy Officer, and Jessica Avery, Director of Advocacy, and member credit unions staff met with the four state congressional delegation, NCUA Chair Kyle Hauptman, and their staff to discuss the pressing issues shaping credit union legislative and regulatory priorities. These conversations provided a valuable opportunity to highlight both the strengths of the credit union system and the policy and regulatory changes needed to ensure continued service to members and communities effectively.

On Wednesday, Senate Banking held a hearing on Deposit Insurance. Hanscom FCU CEO Peter Rice was the only Credit Union voice for the system at the invitation of Senator Warren. CCUA has worked diligently to create the space and political capital to make sure our voices are heard. The advocacy team provided feedback ahead of the hearing and support. Rules Ranking Member, Representative McGovern’s Financial Services Legislative Director met with CCUA staff, who highlighted the NDAA amendment debates and future interchange bills. Delaware Senators Coons and Blunt Rochester’s staffs met with CCUA to discuss and reinforce their interchange and Board Modernization stance. Rhode Island attendees met directly with Senator Whitehouse and Representative Amo and Magaziner, as well as a staffer for Senator Reed, Ranking Member of the Armed Services Committee, which oversees the NDAA. Their conversation open the door for new reconsideration on Reed’s interchange position. New Hampshire members began the morning with Senator Hassan, then spoke with Representative Goodlander, headed to NDAA markups, and met her new legislative director. They also met with Representative Pappas’s financial services director.

Additionally, at the NCUA headquarters Chair Hauptman and staff heard directly from attendees on regulations that prevent them from best serving their members and communities. CCUA is currently working with the NCUA to clarify certain rules regarding housing.

Key highlights include:

- Board Modernization: Aside from having Senator Lisa Blunt Rochester file the bill on behalf of Delaware Credit Union and leads this effort, this week conversation moved the needle forward to get the four state delegation co-sponsor the bill

- FY2026 NDAA Interchange Amendments: Strong concerns about efforts to insert the Credit Card Competition Act and a commissary interchange fee study into the must-pass defense bill, NDAA, were raised. Meetings with both Congressman McGovern and Senator Reed open the door for new consideration in their position.

- Liquidity and Governance Modernization: Measures such as the NCUA Central Liquidity Facility Enhancements Act and passing the Credit Union Board Modernization Act in the Senate.

- Expanding Lending Authority: Proposals to raise the member business lending cap for veteran-owned businesses, increase thresholds for small business loans, and extend loan maturity limits to provide more options for credit union members were discussed.

- Innovation and Consumer Protection: Support for legislation that encourages innovation, including the Unleashing AI Innovation in Financial Services Act, while also backing efforts like the TRAPS Act to fight scams and fraud, was underscored.

- Housing Access and Affordability: Legislation aimed at investing in housing development and offering tax credits to first-time homebuyers.

Thanks to all who participated in these meetings. As credit unions, we demonstrate to lawmakers what we already know – our stories, in our communities improving people’s lives makes all the difference. The CCUA advocacy team with your engagement and input will continue to push these priorities forward and advocate for legislation to empower the credit union industry.